People in America are oftentimes wont to complain of the indifference of the Federal Government, specifically the IRS (Internal Revenue Service), in their confiscation - what in essence amounts to misappropriation - of portions of their earned income. They cringe at the thought of the latest in a long line of tax increases, but choose to remain ignorant of exactly how many taxes they actually pay during the course of their lifetime.

1) Air Transportation Taxes (Factored into the overall cost expenditure associated with air travel)

2) Biodiesel Fuel Taxes

3) Building Permit Taxes

4) Business Registration Fees

5) Capital Gains Taxes

6) Cigarette Taxes

7) Court Fines (Indirect taxes)

8) Disposal Fees

9) Dog License Taxes

10) Drivers License Fees (Another form of taxation)

11) Employer Health Insurance Mandate Tax

12) Employer Medicare Taxes

13) Employer Social Security Taxes

14) Environmental Fees

15) Estate Taxes

16) Excise Taxes on Comprehensive Health Insurance Plans

17) Federal Corporate Taxes

18) Federal Income Taxes

19) Federal Unemployment Taxes

20) Fishing License Taxes

21) Flush Taxes (This fee for the use of one’s toilet as a means of sanitation does exist in some areas of the United States, as this particular fee is factored into water usage and sewage containment and disposal)

22) Food And Beverage License Fees

23) Franchise Business Taxes

24) Garbage Taxes

25) Gasoline Taxes

26) Gift Taxes

27) Gun Ownership Permits

28) Hazardous Material Disposal Fees

29) Highway Access Fees

30) Hotel Taxes (These are becoming quite large in some areas)

31) Hunting License Taxes

32) Import Taxes

33) Individual Health Insurance Mandate Taxes

34) Inheritance Taxes

35) Insect Control Hazardous Materials Licenses

36) Inspection Fees

37) Insurance Premium Taxes

38) Interstate User Diesel Fuel Taxes

39) Inventory Taxes

40) IRA (Individual Retirement Account) Early Withdrawal Taxes

41) IRS (Internal Revenue Service) Interest Charges (Tax on top of tax)

42) IRS Penalties (Tax on top of tax)

43) Library Taxes

44) License Plate Fees

45) Liquor Taxes

46) Local Corporate Taxes

47) Local Income Taxes

48) Local School Taxes

49) Local Unemployment Taxes

50) Luxury Taxes

51) Marriage License Taxes

52) Medicare Taxes

53) Medicare Tax Surcharge on High Earning Americans Under the Patient Protection and Affordable Care Act (PPACA, also known as “Obamacare”)

54) Obamacare Individual Mandate Excise Tax (If you fail to purchase “qualifying” health insurance under Obamacare you will have to pay an additional tax)

55) Obamacare Surtax On Investment Income (A new 3.8% surtax on investment income)

56) Parking Meters

57) Passport Fees

58) Professional Licenses And Fees (Another form of taxation)

59) Property Taxes

60) Real Estate Taxes

61) Recreational Vehicle Taxes

62) Registration Fees for New Businesses

63) Toll Booth Taxes

64) Sales Taxes

65) Self-Employment Taxes

66) Sewer & Water Taxes

67) School Taxes

68) Septic Permit Taxes

69) Service Charge Taxes

70) Social Security Taxes

71) Special Assessments for Road Repairs or Construction

72) Sports Stadium Taxes

73) State Corporate Taxes

74) State Income Taxes

75) State Park Entrance Fees

76) State Unemployment Taxes (SUTA)

77) Tanning Taxes (Newly established regulations incorporated into the PPACA mandate on the owners of tanning salons - and eventually consumers in the form of higher fees as a means of paying the increased financial burden - as a form of health care and disease prevention)

78) Telephone 911 Service Taxes

79) Telephone Federal Excise Taxes

80) Telephone Federal Universal Service Fee Taxes

81) Telephone Minimum Usage Surcharge Taxes

82) Telephone State and Local Taxes

83) Telephone Universal Access Taxes

84) The Alternative Minimum Tax

85) Tire Recycling Fees

86) Tire Taxes

87) Tolls (Another form of taxation)

88) Traffic Fines (Indirect taxation)

89) Use Taxes (Out of state purchases, etc.)

90) Utility Taxes

91) Vehicle Registration Taxes

92) Waste Management Taxes

93) Water Rights Fees

94) Watercraft Registration and Licensing Fees

95) Well Permit Fees

96) Workers Compensation Taxes

97) Zoning Permit Fees

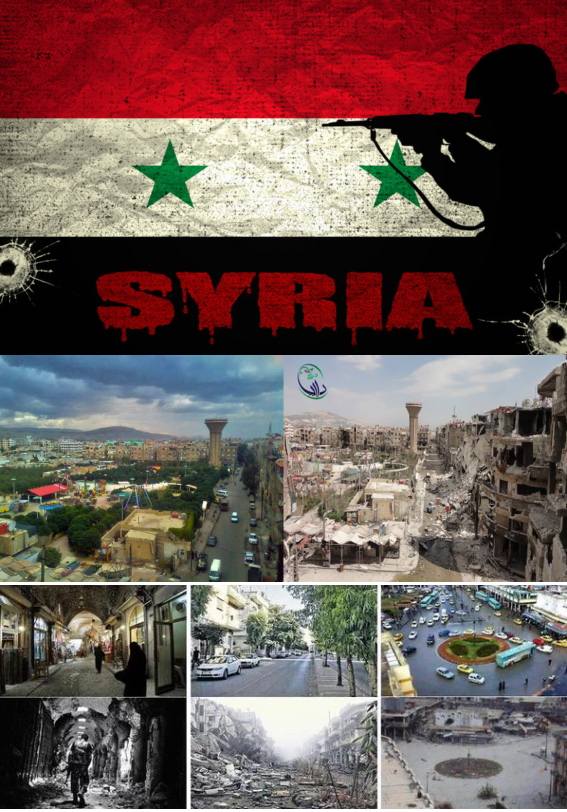

Would that this level of tyranny had been visited upon the countless millions who have come to call portions of Libya, Syria, Iraq, and Yemen home, perhaps the wholesale annihilation of their living standard could have been averted. The pictures that follow serve as illustrative proof of what money can buy - what the American people have essentially been forced to pay for through the Federal Government's current system of involuntary income redistribution.

Should the American people - who, by and large, have made a conscious decision to stand on the sidelines of moral objectivity - be liable for the actions of a political establishment that openly endorses the slaughter of indigenous populations as a point of emphasis in the fulfillment of foreign policy objectives?

That is something each one of us will have to decide for ourselves.

0 comments:

Speak your mind and let your voice be heard.

This is a censorship free discussion area, however, any comments that deviate from the content presented on this site will be subject to removal without notice.